Angel Investing Tip: Shake It Up

Also ask about fundraising details, including how a lot they’re raising, on what valuation, whether with a Secure or notice or priced round, if there are any institutional traders, and if the check size you've got in thoughts works for them. Let folks know that you’re involved in investing, and ask in the event that they wouldn’t thoughts looping you in when they are taking a look at their subsequent firm - may you grab a espresso, take a look at the deck with them, ask what questions they asked, and how are they evaluating the company. Angel investing is a partnership between the angel and startup firm. I began angel investing in 2018. Have made 23 investments to date. You would possibly embody a fast abstract of your angel investing to this point when you've got experience, e.g. what kinds of firms you typically put money into, and maybe a bit about the way you usually work with corporations. Notice: former angel investors raising small funds and investing full-time as sole GPs are a growing development, but are not what this submit is about. At the identical time, so many who lack that form of capital genuinely need to fund good ideas - and the idea of a platform that caters to this large swathe of traders is a rising one.

There's a growing record of profitable startups, together with LeadPages; Study to Live, which gives on-line programs to help folks deal with social anxiety; Sport Ngin (pronounced "engine"), which makes software program for sports activities league web sites, and training-video-sharing startup Vidku, which was launched on the University of Minnesota and raised $17 million in 17 days earlier this 12 months. Customer information - record of present and past customers, most latest new clients, and checklist of misplaced prospects, advertising and gross sales packages. Snapchat could be one of the profitable and latest app ideas that came from three partners, Evan Spiegel, Bobby Murphy, and Bobby Murphy, what started with a classroom undertaking has reached an lively consumer base of one hundred fifty million individuals. In current times, there was an enormous spike in the number of angel buyers and one in all the explanations being angel investors aren't solely motivated by the pure financial returns. Entrepreneurs will raise from angels for a wide range of causes, together with involving associates and family early of their journey, getting focused expertise concerned, not wanting the stress of being “on the clock” with institutional money, and/or to fill out a spherical led by an institutional investor. Networking: Many angels have great skilled networks.

Whether you’re searching for angel investors for your corporation, or seeking to invest in startups, Republic is a superb place to start. Ask the founder what they’re searching for in their angels, so you possibly can ensure you’ll be an excellent match. Eric shared pitch decks, introduced me to other angels, and we chatted through the business models and applied sciences he was taking a look at. These have gotten more popular amongst angels, as it allows them to speculate even greater than they otherwise might. They want to make sure their time and money is paying off, and will even set time frames for when they’d like to see a certain amount of revenue over the years. Even in the event you don’t have the cash to angel invest, you'll be able to keep observe of how the companies you’ve advised did and use that ‘track record’ as a option to transition into an investing role at a fund. As Highline Beta Normal Accomplice, Lauren Robinson explains: ‘early-stage investing is as much a science as it's an art. So as a normal matter I attempt to determine comfort on the massive things like whether or not this is a great group, whether there is a doubtless big market right here and whether there may be a smart, defensible and differentiated product.

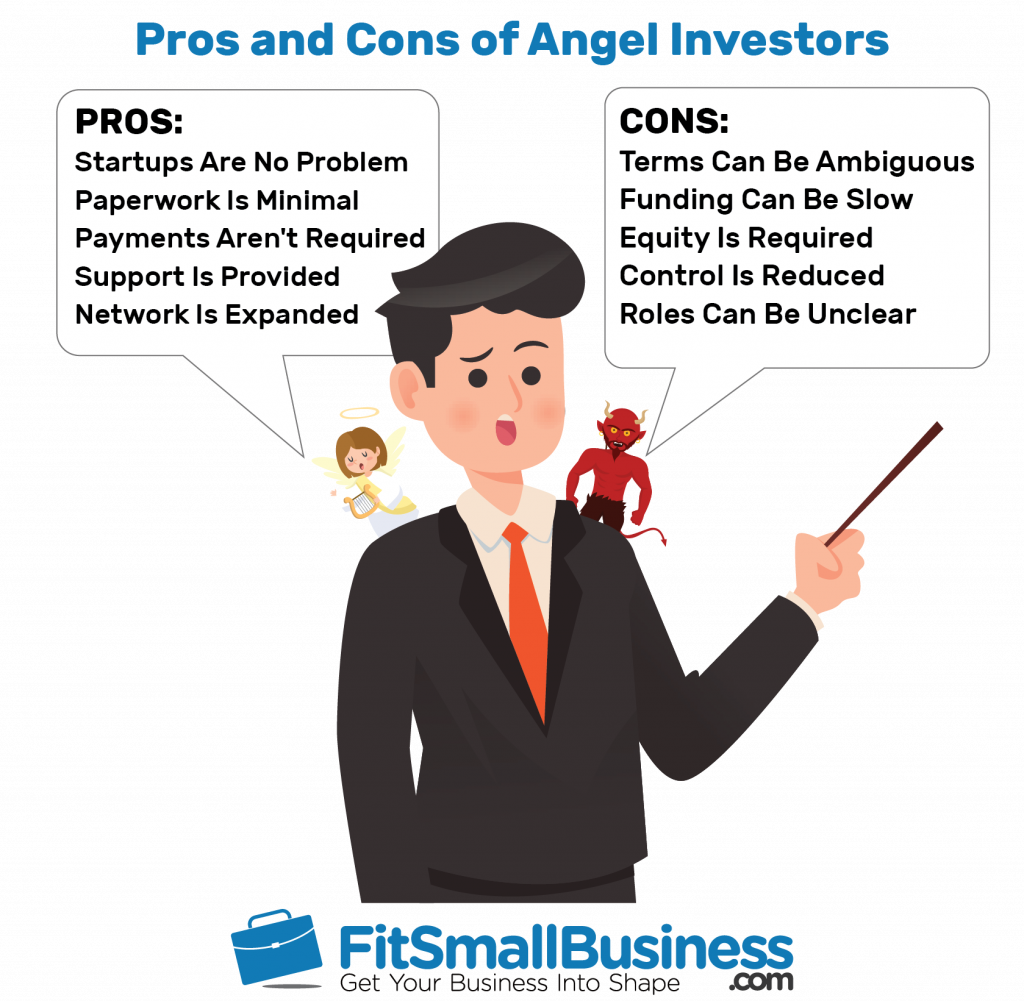

Not all startups seek angel funding, or funding basically. Get the most recent news about Enterprise Entrepreneurs & Angel Buyers and startups. You may have to combat over key business selections along with your traders. A merchant bank is an alternative choice for a business that could be all for a kind of fairness funding. NEXEA Do they agree with your marketing strategy? Nonetheless, they need to have a thoughtful perspective on how they plan to go to market, what checks they want to run to validate their hypotheses here, and a few ideas on clever, differentiated hacks or secrets and techniques they can uniquely benefit from. However, the goal remains identical generally. Angel investors, nevertheless, tend to know these earliest steps within the forming of an organization. Ideally you could have enough capital to make a number of investments since anyone firm has a excessive probability of failure, however how a lot you decide to diversify is up to you. Status is the best option to make your self someone people want to fulfill and get to know, so think about the right way to cultivate that. And eventually, let individuals know you might be investing in order that they consider you when somebody they know is starting or fundraising for one thing attention-grabbing.

Think about why someone ought to want you on their cap desk. Assume by means of what you may offer founders - why ought to they need you on the cap desk? Heat intros from other traders or mates of the founder is another widespread method to fulfill founders. Most of those buyers are entrepreneurs’ friends and members of the family. Angels typically present the first round of “outside” capital-that's, exterior of the founder’s family and associates (the three Fs). Answering to angels: some founders discover angels frustrating, as a result of these buyers count on an important deal and the entrepreneur is taking probably the most danger on the company’s starting. They usually introduced me to other founders. Founders will usually share a pitch deck or memo upfront of the assembly, which it is best to absolutely evaluate in the event that they do, but both way I like to hear the founder pitch the business reside. Whereas I’ve discovered that endorsements from a third party are the most worthy, you may also need to think about the way you may share or show your abilities and perspectives extra publicly to achieve folks outdoors of your network. The angel network permits varied 'angels' to coordinate their activities informally. Each angels and enterprise capitalists typically expect excessive rates of return while financing a new enterprise.

This article has given you insight into what angel investing is, how it differs from enterprise capitals, and what you must anticipate if you have been to change into one. The remainder of this post walks through the nuts and bolts of investing in 4 sections: getting started, pitch conferences, evaluating corporations, and deciding to speculate. There may be quite a bit capital chasing a small variety of corporations, so it’s attainable that despite you reaching out to or meeting with a founder and deciding you want to speculate, you’re not able to get into the deal. Not everyone has a formal sit-down meeting with a founder before deciding to invest, but it’s best practice to get to know the founder (in case you don’t already) and their enterprise thought earlier than investing. Angel investing is a high danger, high reward endeavour for each founders and traders. There is a transparent appetite amongst girls traders to back girls founders or co-founders. Lastly, be clear about next steps, corresponding to when you’ll get again to them. Get enterprise leaders. Moguls as your mentors. Finally, I answer 6 core questions on founder-market fit, customer need, customer acquisition technique, enterprise mannequin, why now, and moats/competitive dynamics. A very good pitch meeting allows the investor to grasp the corporate vision and business mannequin, the founder to understand if the investor can be worth-add and a very good fit, and permits both events time for questions and discussion.

The most important tech company is Optum, a knowledge companies subsidiary of UnitedHealthGroup. But, apart from Shark Tank, there are many alternative funding contests for entrepreneurs, sponsored by big tech corporations, universities, angel investor communities, and others. In case your liked ones are in a monetary position to take action, they could wish to grow to be an angel investor in your enterprise. Establishing a connection early is a superb technique to position yourself as a possible future investor. If competitors secure money injections and invest in talent, know-how or supplies that put them in a greater position to leap on new business opportunities, they'll rapidly eat into the territory of the extra cautious. Lowered control: legally, angels are part homeowners in your corporation. The Los Angeles native also shared the shot on Olympia's Twitter web page accompanied by emojis of angels and a soccer ball. If you’re wonderful at product advertising and marketing, help a founder write copy for their landing web page. Not solely will the fitting investor have entry to delicate details about your organization, but they’ll need to be on the same page about key selections, as well as share the vision outlined in your marketing strategy. A breakdown of funding funds must be offered to potential funding sources inside your marketing strategy.

What’s the business mannequin, and what are the advantages and risks of that mannequin? Perform some research in the marketplace and business mannequin. A new enterprise in at this time's difficult global economic system is more durable than ever, particularly when it is your first time. Whereas discussions have been theoretical at first - I wasn’t asking myself “would I make investments my own money in this? The VC agency wasn’t keen to keep funding the enterprise. I remember feeling nervous earlier than my first pitch meeting as a result of I wasn’t actually positive how they typically went, as I had never seen or been part of a pitch assembly earlier than. You will ship your first products to your backers. Your community would possibly embody friends, co-employees, and/or people you’ve met on Twitter, at occasions, and many others. Private network is usually where people’s first angel investments come from. This is likely to be a ardour that arose from private expertise, or a community or past experience in industry that would give the founder a bonus in constructing the product or reaching customers. You may also meet them by means of your native chamber of commerce, and they could find you thru their personal community or phrase of mouth. Participating with people in the replies and comments could be significantly fruitful each in pushing your individual pondering forward, and broaden your network.